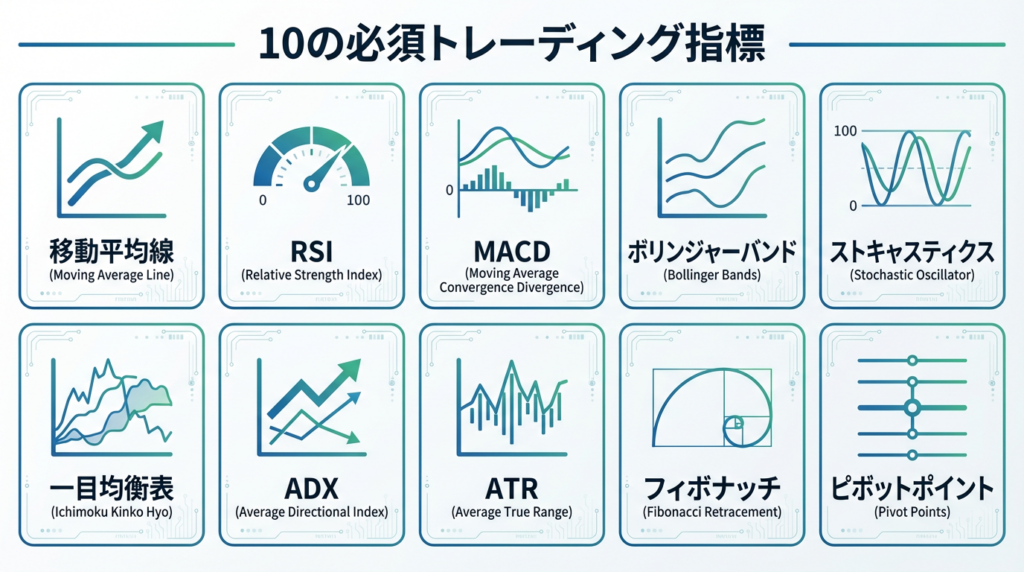

「インジケーターって何を使えばいいの?」 MT4/MT5には数十種類のインジケーターがありますが、初心者が最初から全部覚える必要はありません。この記事では、初心者でも使いやすく効果的な10個のインジケーターを厳選し、使い方から実践的な組み合わせまで徹底解説します!

📈 厳選!初心者におすすめのインジケーター10選

🔍 インジケーターとは?

インジケーターの役割

インジケーター(テクニカル指標)とは、過去の価格・出来高データを計算して視覚化したツールです。チャート分析を助け、エントリー・決済のタイミングを判断するために使用します。

インジケーターの2つのタイプ

1️⃣ トレンド系インジケーター

相場の方向性(トレンド)を見る

- 上昇トレンド・下降トレンドを判断

- 順張り(トレンドフォロー)に有効

- レンジ相場では機能しにくい

代表例:移動平均線、ボリンジャーバンド、一目均衡表、ADX

2️⃣ オシレーター系インジケーター

買われすぎ・売られすぎを見る

- 相場の過熱感を判断

- 逆張り(トレンド転換狙い)に有効

- トレンド相場では誤シグナルが多い

代表例:RSI、MACD、ストキャスティクス

💡 初心者のポイント

トレンド系とオシレーター系を組み合わせることで、より精度の高いトレードが可能になります!

📊 おすすめインジケーター10選

1️⃣ 移動平均線(Moving Average / MA)

📌 基本情報

- タイプ:トレンド系

- 難易度:★☆☆☆☆(超簡単)

- おすすめ度:★★★★★

📖 どんなインジケーター?

一定期間の平均価格を線で結んだもの。相場の方向性を一目で把握できる、最も基本的で重要なインジケーターです。

🔧 おすすめ設定

| 期間 | 設定値 | 用途 |

|---|---|---|

| 短期 | 20 | デイトレード |

| 中期 | 50 | スイングトレード |

| 長期 | 100〜200 | 長期トレンド確認 |

📈 使い方

ゴールデンクロス・デッドクロス

- ゴールデンクロス:短期線が長期線を下から上に抜ける → 買いシグナル

- デッドクロス:短期線が長期線を上から下に抜ける → 売りシグナル

サポート・レジスタンス

- 価格が移動平均線に支えられる → サポートライン

- 価格が移動平均線に押さえられる → レジスタンスライン

✅ メリット

- シンプルで理解しやすい

- トレンドが一目瞭然

- 他のインジケーターと組み合わせやすい

❌ デメリット

- レンジ相場では誤シグナルが多い

- トレンド転換の反応が遅い

2️⃣ RSI(Relative Strength Index)

📌 基本情報

- タイプ:オシレーター系

- 難易度:★★☆☆☆(簡単)

- おすすめ度:★★★★★

📖 どんなインジケーター?

買われすぎ・売られすぎを数値で示すインジケーター。0〜100の範囲で表示され、相場の過熱感を判断できます。

🔧 おすすめ設定

- 期間:14(標準)

- 買われすぎ:70以上

- 売られすぎ:30以下

📈 使い方

基本的な見方

- RSI > 70:買われすぎ → 売りを検討

- RSI < 30:売られすぎ → 買いを検討

- RSI = 50:中立

ダイバージェンス

- 価格は上昇しているのにRSIは下降 → 弱気のダイバージェンス(売りシグナル)

- 価格は下降しているのにRSIは上昇 → 強気のダイバージェンス(買いシグナル)

✅ メリット

- 視覚的にわかりやすい

- 転換点を早めに察知

- レンジ相場で有効

❌ デメリット

- トレンド相場では誤シグナルが多い

- 買われすぎ・売られすぎ状態が長く続くことがある

3️⃣ MACD(Moving Average Convergence Divergence)

📌 基本情報

- タイプ:オシレーター系

- 難易度:★★★☆☆(普通)

- おすすめ度:★★★★★

📖 どんなインジケーター?

2本の移動平均線の差を表示し、トレンドの発生・転換を判断できるインジケーター。世界中のプロトレーダーが愛用しています。

🔧 おすすめ設定

- 短期EMA:12

- 長期EMA:26

- シグナル線:9

📈 使い方

MACDラインとシグナル線のクロス

- ゴールデンクロス:MACDラインがシグナル線を下から上に抜ける → 買いシグナル

- デッドクロス:MACDラインがシグナル線を上から下に抜ける → 売りシグナル

ゼロラインクロス

- MACDラインがゼロラインを上抜ける → 上昇トレンド開始

- MACDラインがゼロラインを下抜ける → 下降トレンド開始

✅ メリット

- トレンドの強さを視覚的に把握

- 初心者でも判断しやすい

- RSIと組み合わせると精度UP

❌ デメリット

- レンジ相場では誤シグナルが多い

- シグナルが遅れることがある

4️⃣ ボリンジャーバンド(Bollinger Bands)

📌 基本情報

- タイプ:トレンド系

- 難易度:★★☆☆☆(簡単)

- おすすめ度:★★★★☆

📖 どんなインジケーター?

移動平均線を中心に、統計学的に価格が収まる範囲を表示するバンド。相場のボラティリティ(変動幅)を視覚化します。

🔧 おすすめ設定

- 期間:20

- 偏差:2(±2σ)

📈 使い方

バンドウォーク

- 価格が上部バンドに沿って上昇 → 強い上昇トレンド

- 価格が下部バンドに沿って下降 → 強い下降トレンド

スクイーズ・エクスパンション

- スクイーズ:バンド幅が狭まる → レンジ相場、ブレイクアウト前兆

- エクスパンション:バンド幅が広がる → トレンド発生

逆張り

- 価格が上部バンドに触れる → 売りシグナル

- 価格が下部バンドに触れる → 買いシグナル

✅ メリット

- ボラティリティが一目でわかる

- 順張り・逆張り両方で使える

- 視覚的にわかりやすい

❌ デメリット

- トレンド相場では上部・下部バンドにタッチしても反転しないことが多い

5️⃣ ストキャスティクス(Stochastic Oscillator)

📌 基本情報

- タイプ:オシレーター系

- 難易度:★★★☆☆(普通)

- おすすめ度:★★★★☆

📖 どんなインジケーター?

RSIと似た買われすぎ・売られすぎを判断するインジケーター。より敏感に反応するため、短期トレードに向いています。

🔧 おすすめ設定

- %K期間:5

- %D期間:3

- スローイング:3

📈 使い方

基本的な見方

- 80以上:買われすぎ → 売りを検討

- 20以下:売られすぎ → 買いを検討

ゴールデンクロス・デッドクロス

- ゴールデンクロス:%Kラインが%Dラインを下から上に抜ける → 買いシグナル

- デッドクロス:%Kラインが%Dラインを上から下に抜ける → 売りシグナル

✅ メリット

- RSIより反応が早い

- 短期トレードに最適

- レンジ相場で有効

❌ デメリット

- シグナルが多すぎる(ダマシが多い)

- トレンド相場では使いにくい

6️⃣ 一目均衡表(Ichimoku Kinko Hyo)

📌 基本情報

- タイプ:トレンド系

- 難易度:★★★★☆(やや難しい)

- おすすめ度:★★★☆☆

📖 どんなインジケーター?

日本発祥の総合的なトレンド分析ツール。5本の線と雲で構成され、トレンド・サポレジ・売買シグナルをすべて表示できます。

🔧 標準設定

- 転換線:9

- 基準線:26

- 先行スパン:52

📈 使い方

雲(抵抗帯)

- 価格が雲の上 → 上昇トレンド

- 価格が雲の中 → レンジ相場

- 価格が雲の下 → 下降トレンド

三役好転・三役逆転

- 三役好転:転換線が基準線を上抜け + 価格が雲の上 + 遅行スパンが価格を上抜け → 強い買いシグナル

- 三役逆転:その逆 → 強い売りシグナル

✅ メリット

- 一目でトレンド・強弱がわかる

- 日本人トレーダーに馴染み深い

- 多機能で総合判断可能

❌ デメリット

- 理解が難しい

- 初心者には複雑すぎる

- チャートが見づらくなる

7️⃣ ADX(Average Directional Index)

📌 基本情報

- タイプ:トレンド系

- 難易度:★★★☆☆(普通)

- おすすめ度:★★★☆☆

📖 どんなインジケーター?

トレンドの強さを数値化するインジケーター。方向性ではなく「強さ」を判断できる点が特徴です。

🔧 おすすめ設定

- 期間:14

📈 使い方

ADX値の判断

- ADX < 20:トレンドなし(レンジ相場)

- ADX 20〜40:弱いトレンド

- ADX > 40:強いトレンド

✅ メリット

- トレンドの強さを客観的に判断

- レンジ相場とトレンド相場を見分けられる

- トレンドフォロー戦略に最適

❌ デメリット

- 方向性はわからない

- 単独では使いにくい

8️⃣ ATR(Average True Range)

📌 基本情報

- タイプ:ボラティリティ系

- 難易度:★★★☆☆(普通)

- おすすめ度:★★★☆☆

📖 どんなインジケーター?

**ボラティリティ(価格変動幅)**を数値化するインジケーター。損切り幅の設定に役立ちます。

🔧 おすすめ設定

- 期間:14

📈 使い方

ボラティリティ判断

- ATR値が高い:価格変動が大きい → 損切り幅を広く

- ATR値が低い:価格変動が小さい → 損切り幅を狭く

損切りラインの設定

損切りライン = エントリー価格 ± (ATR × 2)

✅ メリット

- リスク管理に最適

- 適切な損切り幅がわかる

- ボラティリティを客観的に把握

❌ デメリット

- 単独では売買シグナルを出さない

- 補助的なインジケーター

9️⃣ フィボナッチリトレースメント(Fibonacci Retracement)

📌 基本情報

- タイプ:トレンド系

- 難易度:★★★★☆(やや難しい)

- おすすめ度:★★★☆☆

📖 どんなインジケーター?

押し目・戻りの目標価格を予測するツール。黄金比(フィボナッチ比率)を使って、価格が反発しやすいポイントを表示します。

🔧 重要な比率

- 23.6%:浅い押し目・戻り

- 38.2%:標準的な押し目・戻り

- 50.0%:半値戻し

- 61.8%:深い押し目・戻り(最重要)

- 78.6%:非常に深い押し目・戻り

📈 使い方

- トレンドの起点と終点を選択

- フィボナッチラインを引く

- 各ラインで反発を待つ

上昇トレンドの押し目買い

- 価格が38.2%〜61.8%まで下落 → 買いエントリー検討

下降トレンドの戻り売り

- 価格が38.2%〜61.8%まで上昇 → 売りエントリー検討

✅ メリット

- 押し目・戻り目を客観的に判断

- 世界中のトレーダーが注目

- 利確・損切りラインにも使える

❌ デメリット

- 引き方に個人差がある

- 初心者には難しい

🔟 ピボットポイント(Pivot Point)

📌 基本情報

- タイプ:トレンド系

- 難易度:★★☆☆☆(簡単)

- おすすめ度:★★★☆☆

📖 どんなインジケーター?

前日の高値・安値・終値から当日の目標価格を計算するインジケーター。サポート・レジスタンスラインとして機能します。

🔧 計算式

ピボットポイント(PP)= (高値 + 安値 + 終値) ÷ 3

レジスタンス1(R1)= PP × 2 - 安値

サポート1(S1)= PP × 2 - 高値

📈 使い方

トレンド判断

- 価格がPPより上 → 上昇トレンド

- 価格がPPより下 → 下降トレンド

サポート・レジスタンス

- R1、R2:レジスタンスライン

- S1、S2:サポートライン

✅ メリット

- 客観的なサポレジライン

- デイトレードに最適

- シンプルで使いやすい

❌ デメリット

- 日足以外では機能しにくい

- ボラティリティが高いと機能しない

🎯 インジケーターの組み合わせ例

🔰 初心者におすすめの組み合わせ

組み合わせ①:移動平均線 + RSI

最もシンプルで効果的

- 移動平均線:トレンド方向を確認

- RSI:買われすぎ・売られすぎを確認

エントリー例:

- 移動平均線が上向き(上昇トレンド)

- RSIが30以下(売られすぎ)

- 買いエントリー

組み合わせ②:ボリンジャーバンド + MACD

トレンドフォロー型

- ボリンジャーバンド:トレンドとボラティリティを確認

- MACD:エントリータイミングを確認

エントリー例:

- バンドがエクスパンション(トレンド発生)

- MACDがゴールデンクロス

- 買いエントリー

組み合わせ③:RSI + MACD

オシレーター系の組み合わせ

- RSI:買われすぎ・売られすぎ

- MACD:トレンド転換

エントリー例:

- RSIが30以下(売られすぎ)

- MACDがゴールデンクロス

- 買いエントリー

🏆 中級者におすすめの組み合わせ

組み合わせ④:移動平均線 + ボリンジャーバンド + ADX

トレンド強度を加味

- 移動平均線でトレンド方向確認

- ボリンジャーバンドでエントリータイミング

- ADXでトレンドの強さ確認(40以上で強いトレンド)

組み合わせ⑤:一目均衡表 + RSI

日本人トレーダーの王道

- 一目均衡表で総合判断

- RSIで過熱感を確認

- 三役好転 + RSI50以上で買い

⚙️ インジケーターの追加方法(MT4/MT5)

PC版での追加方法

ステップ1:インジケーター一覧を開く

- MT4/MT5を起動

- 上部メニュー「挿入」→「インジケーター」をクリック

ステップ2:カテゴリを選択

- トレンド系:「トレンド」

- オシレーター系:「オシレーター」

- ボリューム系:「ボリューム」

- カスタム:「カスタム」

ステップ3:インジケーターを選択

使いたいインジケーターをクリック

ステップ4:設定を入力

- 期間

- 色

- 線の太さ など好みに合わせて設定

ステップ5:「OK」をクリック

チャート上にインジケーターが表示されます

スマホ版での追加方法

ステップ1:チャートを表示

- MT4/MT5アプリを起動

- 気配値から通貨ペアを選択

- チャートを表示

ステップ2:インジケーター一覧を開く

- チャート画面を横向きに

- 画面上部の「f」アイコンをタップ

ステップ3:インジケーターを選択

- 「メインウィンドウ」:チャート上に表示(移動平均線など)

- 「インジケータウィンドウ」:チャート下に表示(RSI、MACDなど)

ステップ4:設定を入力

期間や色を設定して「追加」をタップ

詳細手順:XMインジケーター追加方法

❌ 初心者がやりがちな失敗

失敗①:インジケーターを入れすぎる

チャートが見づらくなり、判断が遅れる

✅ 対策:最大3〜4個までに絞る

失敗②:シグナルをすべて信じる

ダマシが多く、損失が膨らむ

✅ 対策:複数のインジケーターで確認する

失敗③:設定値を頻繁に変える

一貫性がなくなり、検証できない

✅ 対策:標準設定で最低1ヶ月は使い続ける

失敗④:レンジ相場でトレンド系を使う

誤シグナルが連発する

✅ 対策:相場環境に応じて使い分ける

失敗⑤:インジケーターだけで判断

ファンダメンタルズを無視する

✅ 対策:経済指標・ニュースも確認する

💡 インジケーター活用のコツ

1️⃣ 相場環境を見極める

- トレンド相場:トレンド系インジケーターを重視

- レンジ相場:オシレーター系インジケーターを重視

2️⃣ 複数の時間足を確認

- 長期足でトレンド確認

- 短期足でエントリータイミング確認

3️⃣ 損切りラインを必ず設定

インジケーターのシグナルが外れることを前提に、必ず損切り設定を!

4️⃣ 過去チャートで検証

実際の取引前に、過去チャートで「このシグナルは有効だったか?」を確認

5️⃣ 自分に合うものを見つける

万能なインジケーターはありません。自分のトレードスタイルに合ったものを見つけましょう。

📊 インジケーター比較表

| インジケーター | タイプ | 難易度 | トレンド相場 | レンジ相場 | おすすめ度 |

|---|---|---|---|---|---|

| 移動平均線 | トレンド系 | ★☆☆☆☆ | ⭕ | ❌ | ★★★★★ |

| RSI | オシレーター系 | ★★☆☆☆ | △ | ⭕ | ★★★★★ |

| MACD | オシレーター系 | ★★★☆☆ | ⭕ | △ | ★★★★★ |

| ボリンジャーバンド | トレンド系 | ★★☆☆☆ | ⭕ | ⭕ | ★★★★☆ |

| ストキャスティクス | オシレーター系 | ★★★☆☆ | △ | ⭕ | ★★★★☆ |

| 一目均衡表 | トレンド系 | ★★★★☆ | ⭕ | △ | ★★★☆☆ |

| ADX | トレンド系 | ★★★☆☆ | ⭕ | △ | ★★★☆☆ |

| ATR | ボラティリティ系 | ★★★☆☆ | ⭕ | ⭕ | ★★★☆☆ |

| フィボナッチ | トレンド系 | ★★★★☆ | ⭕ | △ | ★★★☆☆ |

| ピボットポイント | トレンド系 | ★★☆☆☆ | ⭕ | ⭕ | ★★★☆☆ |

❓ よくある質問(FAQ)

Q1:どのインジケーターから始めるべき?

A: まずは移動平均線とRSIから始めましょう。シンプルで理解しやすく、効果も高いです。

Q2:インジケーターは何個まで使える?

A: MT4/MT5には制限はありませんが、3〜4個までに絞るのがおすすめ。多すぎるとチャートが見づらくなります。

Q3:標準設定を変えてもいい?

A: 最初は標準設定で使いましょう。慣れてきたら、自分のトレードスタイルに合わせて微調整してください。

Q4:インジケーターだけで勝てる?

A: いいえ。インジケーターは補助ツールです。資金管理・リスク管理・相場環境の把握が最も重要です。

Q5:有料インジケーターは必要?

A: 初心者のうちは不要です。標準搭載のインジケーターで十分勝てます。

Q6:スマホでもインジケーターは使える?

A: はい、MT4/MT5アプリで90種類以上のインジケーターが使えます。

Q7:インジケーターが表示されない場合は?

A: チャート画面を横向きにして、「f」アイコンから追加してください。

Q8:カスタムインジケーターは使える?

A: はい、PC版ならカスタムインジケーターも追加できます。ただし、初心者は標準インジケーターから始めましょう。

🎯 まとめ:インジケーターを使いこなそう

✅ 初心者が覚えるべきインジケーター

- 移動平均線:トレンドの方向性

- RSI:買われすぎ・売られすぎ

- MACD:トレンド転換

- ボリンジャーバンド:ボラティリティ

この4つをマスターすれば、十分に勝てるトレーダーになれます!

📈 おすすめの組み合わせ

- 初心者:移動平均線 + RSI

- デイトレーダー:ボリンジャーバンド + MACD

- スキャルパー:RSI + ストキャスティクス

💡 最も重要なこと

インジケーターは万能ではありません。

- 資金管理

- リスク管理

- 損切りルール

- 相場環境の把握

これらを徹底した上で、インジケーターを補助ツールとして活用しましょう!

🎁 今なら15,000円の口座開設ボーナス!

XMTradingなら、入金不要で15,000円のボーナスをもらえます。まずはデモ口座でインジケーターを試して、リアル口座でボーナスを使って取引してみましょう!

🔗 関連記事

- XMTrading取引プラットフォーム完全ガイド(MT4 vs MT5)

- 失敗談から学ぶ!初心者がXMTradingで気をつけるべきこと

- 【2025年最新】XMTrading口座開設の全手順|画像付き完全ガイド

- XMTradingのボーナス活用術|15,000円を最大限に使う方法